The 20-Year 'Buy And Hold' Investment Journey: A Closer Look at Williams Cos Inc

Explore how a long-term investment strategy with Williams Cos Inc could have transformed $10,000 into nearly $92,500 over two decades.

The Power of Long-Term Investments

Warren Buffett once famously advised that the best holding period for outstanding businesses with outstanding managements is forever. This mantra resonates with many investors who are trying to decide whether to hold onto their shares amidst market fluctuations. Back in 2005, those who took this advice and invested in Williams Cos Inc (NYSE: WMB) hoped for substantial long-term gains. Today, thanks to careful analysis, we can see the significant returns from buying and holding WMB over two decades.

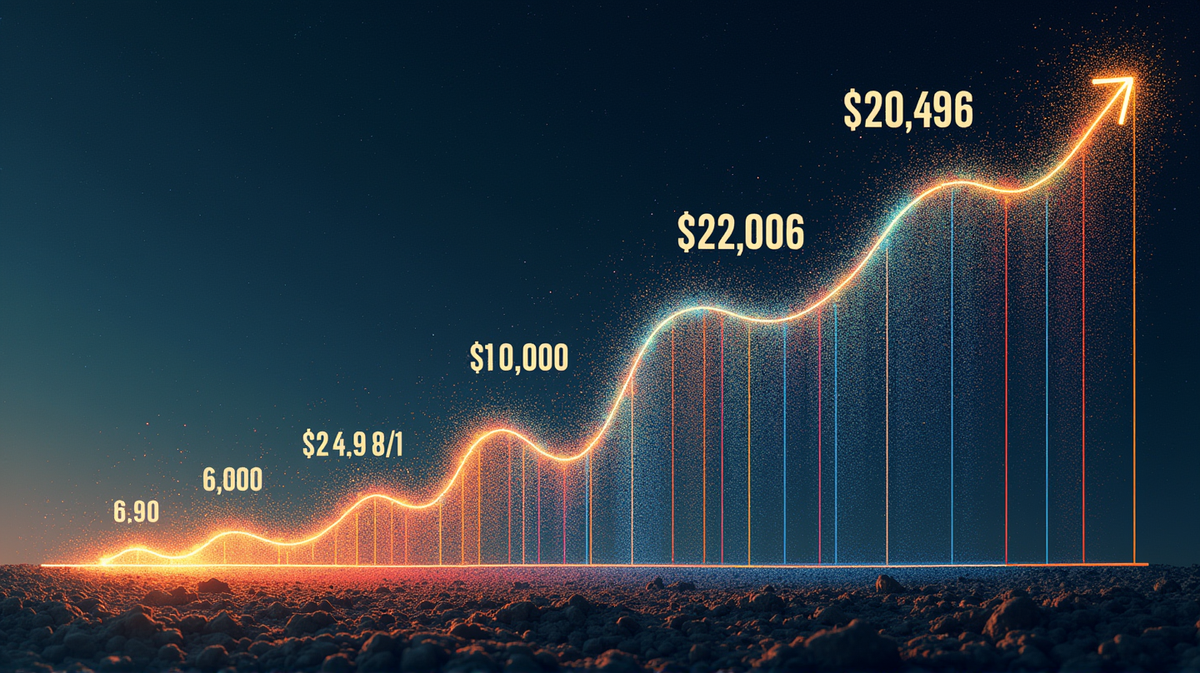

A Snapshot of Growth: From \(10,000 to \)92,496

If you had invested \(10,000 in WMB on June 6, 2005, your investment would be worth about \)92,496 today, marking an incredible 825.18% increase. The original share price of \(15.35 has climbed to \)60.12, boosted by reinvested dividends that added $24.43 per share to the value. The annualized return clocks in at an impressive 11.76%. According to mmjstockwatch.com, these results reflect the power of compounding and the benefits of remaining invested for the long term.

Dividends: A Game Changer

An important aspect of the WMB investment success story is the role of dividends. Over the past 20 years, WMB has paid significant dividends, allowing investors to compound their returns further by reinvesting these payments into additional shares. The current yield of approximately 3.33% coupled with a ‘yield on cost’ of 21.69% showcases just how powerful dividends can be in growing investment over time.

What Lies Ahead?

Examining the first 20 years of this investment can provide insights into potential future performance. While past success is not necessarily indicative of future results, the resilience shown by WMB suggests a bright future. The business’s ability to sustain and grow dividends is a testament to its robust fundamentals and financial health.

Boring, Yet Rewarding: A Final Thought

George Soros wisely noted that good investing should not be about entertainment or excitement, but about stability and predictable returns. As we look back on the 20-year journey with WMB, it’s clear that patience and a focus on high-quality stocks have paid off handsomely. What’s next for WMB? That’s for another two-decade chapter to reveal.